Articles Articles |

Daniel R. Amerman, CFA,

InflationIntoWealth.com

Actual losses in the US real estate market are much higher than what you have been reading in the newspapers recently. Using a combination of official government statistics and the most widely used index of housing values, we will demonstrate that the US real estate market has lost a total of $6 trillion in value in the last two years. We will show that an average house that was worth about $226,000 in 2006 is, once you adjust for inflation, down to a real value of only about $160,000. To put what a $6 trillion loss is into perspective, we will show that when all factors are taken into account, the two year drop in US real estate values is equivalent to wiping out the entire retirement savings of all 78 million Baby Boomers, and annual housing losses are close to the annual GDP of China. We will close by talking about how this national disaster creates major personal profit opportunities for people who can learn to look beyond the false number of nominal dollars and into the reality of how wealth is rapidly redistributed during times of economic turmoil.

To understand the full extent of US real estate value losses requires a four step process: 1) Find the average loss in dollar terms for single family homes; 2) Find the decline in the value of a dollar during the same period; 3) Combine the fall in housing values with the fall in the value of the dollar to find the real housing loss, not in dollars, but in purchasing power, or what a dollar will buy for you; and 4) Determine the loss for the US economy as a whole.

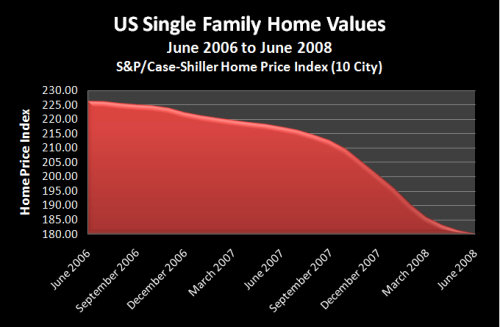

The widely quoted S&P/Case-Shiller Home Price Index reached its maximum value during the month of June, 2006 at a level of 226.29 (10- City Composite). Two years later, by June of 2008, the index had reached a level of 180.38. The fall of 45.91 in index value means a 20.29% decline in the average value of a home in the cities measured. This decline is illustrated in the graph below:

The most common measure of the

decline in the value of a dollar is the Consumer Price Index (CPI). Unfortunately, it is growing increasingly

difficult to find consumers who believe the CPI accurately reflects the prices

they are paying in such crucial areas as energy, food or medical care. (This disbelief is particularly strong among

those living on a fixed income.) Indeed,

when inflation is measured using the same statistical methods of past decades,

it is above 10%, according to John Williams of Shadowstats.com.

Therefore, for this analysis, we

will compromise between the official rate of inflation, and a widespread belief

in higher actual rates of inflation, by using a different official government

inflation index, that of the Producer Price Index (PPI), which measures

wholesale inflation. (To the extent that

wholesale inflation tends to lead retail inflation, the two indexes should be

converging anyway before too long.) The

Producer Price Index in June of 2008 set a 27 year record with a 9.2% twelve

month rate of inflation. The last time

inflation was this high was the same year that Treasury yields exceeded 15%,

and 30 year mortgage rates exceeded 16%.

We are in the midst of an extraordinarily rapid destruction of the value

of a dollar.

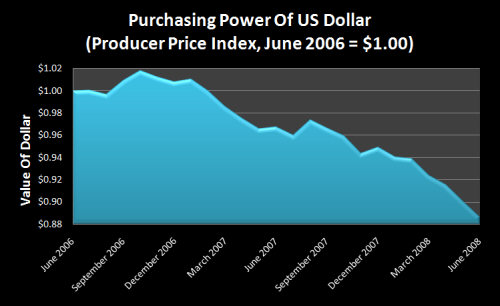

This is shown in the graph below, which illustrates monthly changes in the value of a dollar over the last two years, based upon monthly changes in the PPI. As shown, by June of 2008, a dollar would only buy what 88.7 cents would have purchased in 2006.

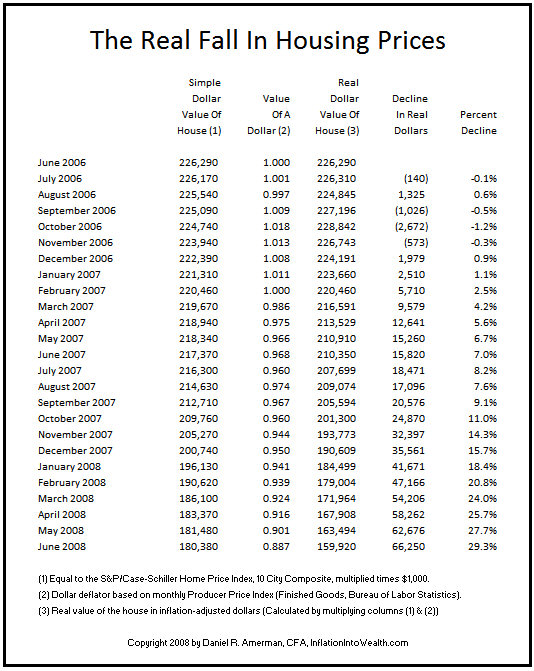

There is a basic problem with the 20% decline in the dollar value of single family homes over the last two years, and that is that those dollars themselves are worth less than they were two years ago. So, if we want to look at the real value of homes, then we need to adjust our home values for inflation. For dollars themselves aren’t what matter – it is what you can buy with those dollars. The chart below shows what happens when we combine the 20% decline in the real estate index with the 11% decline in the value of the dollar.

As you can see by following the June

2007 line, twelve months after the real estate peak, the index value of the

average house was down 9 points, or 4.0%.

However, the value of the dollar had also fallen 3.2% during that time, so

that by December a dollar would only buy what 96.8 cents would have bought in

June. When we combine the two, with 4%

fewer dollars and each of those dollars being worth 3.2% less, then on a real

(purchasing power adjusted basis) the average homeowner lost 7.0% of the value

of their home during that year, as can be seen in the rightmost column. In other words, real homeowner losses were

75% greater than what was widely reported.

| Click Here To Learn About A Free Mini Course That Will Teach You How To Turn Inflation Into Wealth. |

As we go forward to December of2007, eighteen months after the peak, the decline in the value of the housing

market was really starting to pick up, with a loss in the index of 26 points,

or 11.3%. Unfortunately, the rate of

inflation was also beginning to pick up, and the dollar had fallen 5% over the eighteen

months, meaning a dollar would only buy what 95 cents did in June of 2006. So a house is worth 88.7 cents on the dollar,

but the dollar itself is only worth 95 cents, and when we combine the two, the

real value of the average house fell 15.7%.

This was about 40% greater than what was widely reported.

By the time we reach June of 2008,

then as shown above, the real estate index was down to 180.38, a full 20% decline. The dollar was down to 88.7 cents, as it had

lost 11.3% of it’s value. When we

combine the two, we say that a average $226,290 house in 2006 only has a market

value of $180,380 by June of 2008, and when we also include that a 2008 dollar

is only worth 88.7 cents – then the real value of our house is not $180,380,

but $159,920.

When

we adjust for inflation, a house that was worth $226,000 in 2006, is down to a

real value of only $160,000 in 2008.

Which means the real dollar loss is not $45,910 – but $66,250. Thus, the real percentage loss is not 20% - but 30%. The real loss in homeowner wealth has been a full 50% greater than what is being widely reported in the media.

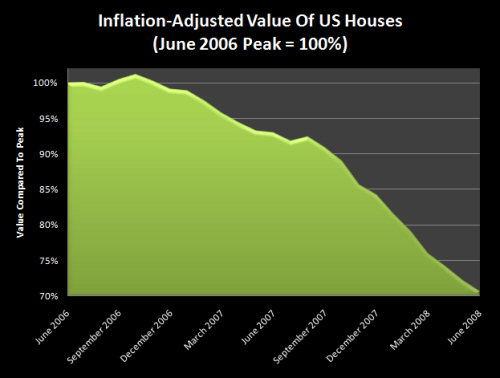

How big of a blow is a 30% decline

in housing values to the US economy and national wealth? For the answer to that, we will turn to the Federal

Reserve. As of 2006, Federal Reserve

statistics show that total household real estate assets were $19.8 trillion

(Statistical release Z.1 (Flow of Funds), table B.100( Household Balance

sheet), line 4). So, we start with $19.8

trillion and multiply times the 29.3% real two year decline in home values that

is in the bottom right hand corner of the chart.

$20

trillion in 2006 real estate, times 30% inflation-adjusted real estate losses

between 2006 and 2008, is a $6 trillion dollar loss in homeowner wealth

(rounded numbers).

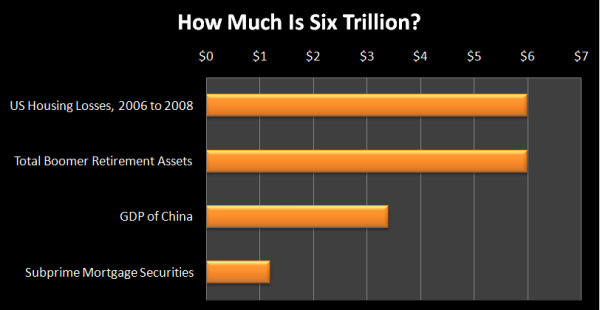

What is $6 trillion? Numbers that large are difficult to grasp,

but 6 trillion is equal to 6 million, times 1 million. So a six trillion dollar loss is equal to six

million people each having a million dollars, and each having their entire net

worth wiped out. Six million millionaires, each losing every penny.

Another way of viewing $6 trillion

is that as of 2006, it was equal to the sum of Baby Boomer retirement account

investments, as well as pension investments dedicated to funding Boomer

retirements (a detailed methodology for the $6 trillion in 2006 figure can be

found in my previous research report “Adding Up $44 Trillion In Boomer Wealth

Expectations”). A $6 trillion drop in value is equal to wiping out 100% of the

retirement savings accounts and pension investment values for all 78 million US

Baby Boomers between ages 44 and 62.

For additional perspective on the

value of $6 trillion, the Chinese economy reached a GDP of $3.4 trillion in

2007, according to the Chinese news agency Xinhua. That

means that over the last two years, the US housing market has been losing value

at a rate almost equal to the size of the entire Chinese economy, the

economic juggernaut that is currently driving much of the growth of the global

economy.

(The

Purchasing Power Parity (PPP) measure of the Chinese economy at $7 trillion for

2007 (as calculated in the CIA Factbook) is a much better measure than a GDP

that is based upon blatantly manipulated currency values, but using such

currency values as if a (non-existent) fair market had established them is the

norm for financial reporting, so we’ll use it here. Even if we use the PPP, the loss in wealth

compared to the Chinese economy is still extraordinary.)

Yet another way of looking at the size of $6 trillion is to compare it to the source of much of the plunge in value for real estate, which is the subprime mortgage securities market. The subprime debacle, which has shaken the global financial system and ravaged four of the strongest financial institutions in the US (Fannie, Freddie, MBIA and AMBAC), took place in a $1.2 trillion market. The two year loss in US housing values is five times the size of the total subprime mortgage securities market.

As can readily be seen above, the

two year collapse in US housing values is a financial disaster of epic proportions.

(Note that the $6 trillion loss shown does not reconcile with Federal Reserve real estate values for 2008, which show total real estate asset values of $19.7 trillion as of the first quarter, meaning essentially no fall in real estate values. Curiously enough, the official government statistics seem to do a remarkably good job of rising fast with rising real estate values, yet, don’t seem to reflect bad news at all. Much like some of the most… interesting… inflation numbers that the government has been using lately to claim that the economy is still growing fast, as measured by the GDP. More on this subject can be found in my article “Inflation Index Manipulation: Theft By Statistics”.)

Let’s think for a moment about

recent financial history. How about the

collective “wisdom” of the markets pushing the NASDAQ to 5,000 – and then 80%

of that value quickly imploding as the NASDQ fell to 1,000. Then there is this most recent episode, where

it appears the collective brilliance of the markets ran up a little $6 trillion

(and still counting) pricing mistake. Just a little rounding error, twice the size

of the economy of China. Now, let’s

think about the safety of your retirement and other investment assets. When you direct your IRA and 401 plans, when

you plan your retirement income, what is your source of safety for your stock

and bond investments? In the financial

profession, your ultimate source of safety is what is known as the “Efficient

Market Hypothesis”, which just basically says that the awesome wisdom and

intelligence of the markets makes sure that all securities are always fairly

priced.

Given what we’ve seen just in the

last decade – how confident are you about this collective brilliance of the

markets? Confident enough to risk every

penny of your retirement savings? Yet,

you must invest and invest well – or inflation will eat your savings, and you

will be impoverished anyway. So, what do

you do?

A place to start is to very

seriously think about reducing your ownership of financial assets. If you are investing for retirement and your portfolio of stocks and bonds gets

taken down by broad market developments similar to what has already happened

with real estate and tech stocks just in the last seven years, then you may

never have the chance to replace retirement savings. There is a powerful, powerful case for moving

a substantial portion of your assets into tangible assets. Good examples of tangible assets include

gold, silver, commodities, farmland and energy – and yes, real estate. Not at the peak of a bubble, but at the right

time and the right price.

The next thing you should do is very

seriously think about is whether crisis leads to opportunity, in ways that go

well beyond a simple strategy of only buying tangible assets. As a prominent recent example, John Paulson

saw the crisis that was coming in subprime mortgages, researched and educated

himself on this area (which had not been his field of expertise), and he turned

the crisis into a $3-$4 billion personal payday in 2007. If you're not a hedge fund manager like

Paulson, you may not have the tools that he used to turn a market crisis into

personal billions. That’s OK, because

Paulson didn’t start with the tools either.

He started with educating himself, learning about a new area, until he

came up with a novel way to profit from disaster. A method that wasn’t in the financial

textbooks, and that he didn’t find by reading a financial columnist in the

paper.

You have more tools than you may

think, some of which may surprise you.

Tools which can give you the opportunity to turn financial disaster into

personal net worth. There are ways you

can use those tools to turn the $6 trillion fall in real estate values in

combination with the destruction of the US dollar into perhaps the greatest

real wealth-building opportunity of your life, on a long-term and

tax-advantaged basis.

But, if you want this to happen –

then education is the essential first step.

You are going to have to not just understand, but to master some of the

financial forces and methods in play here.

You will have to learn how to turn the destruction of paper wealth into

real wealth. With Turning Inflation Into

Wealth being the first key step. My best

wishes to you for turning this challenge into an extraordinary personal

opportunity.

Do you

know how to Turn Inflation Into Wealth? To position yourself so that inflation will

redistribute real wealth to you, and the higher the rate of inflation – the

more your after-inflation net worth grows?

Do you know how to achieve these gains on a long-term and tax-advantaged

basis? Do you know how to potentially

triple your after-tax and after-inflation returns through Reversing The

Inflation Tax? So that instead

of paying real taxes on illusionary income, you are paying illusionary taxes on

real increases in net worth? These are

among the many topics covered in the free “Turning Inflation Into

Wealth” Mini-Course. Starting simple,

this course delivers a series of 10-15 minute readings, with each

reading building on the knowledge and information contained in previous

readings. More information on the course

is available at InflationIntoWealth.com .

Contact Information:

Daniel R. Amerman, CFA

Website: http://InflationIntoWealth.com/

E-mail: mail@the-great-retirement-experiment.com

This

essay and the websites, mini-course, books and audio recordings, contain the ideas

and opinions of the author. They are conceptual explorations of general

economic principles, and how people may – or may not – interact in the

future. As with any discussion of the future, there cannot be any

absolute certainty. What this website does not contain is specific

investment, legal or any other form of professional advice. If specific

advice is needed, it should be sought from an appropriate professional.

Any liability, responsibility or warranty for the results of the application of

principles contained in the website, pamphlets, recordings, books and other

products, either directly or indirectly, are expressly disclaimed by the

author.